28+ Irs Non Filing Letter Sample

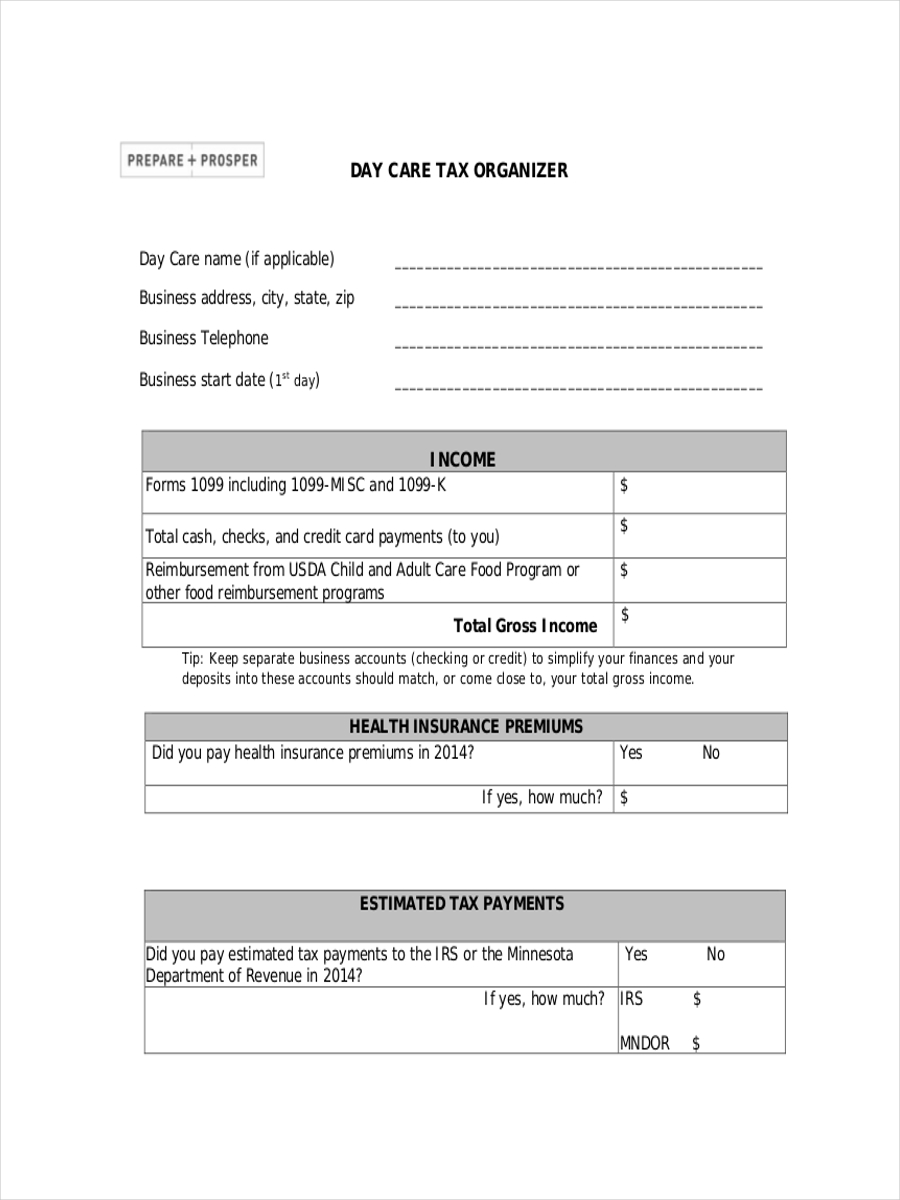

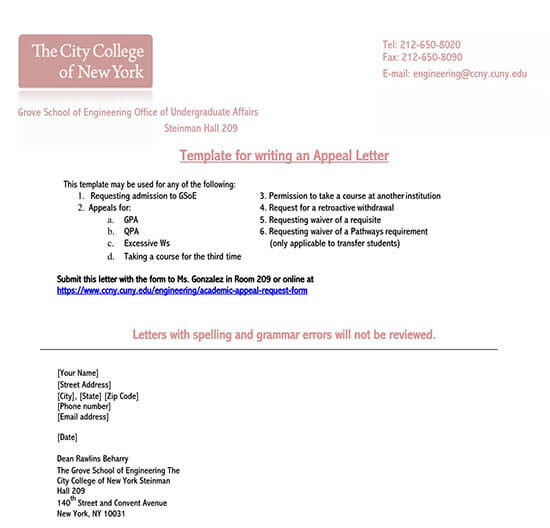

Complete lines 1 4 following the instructions. CHOOSE 1 OF THE FOLLOWING THAT BEST APPLIES TO YOUR SITUATION.

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

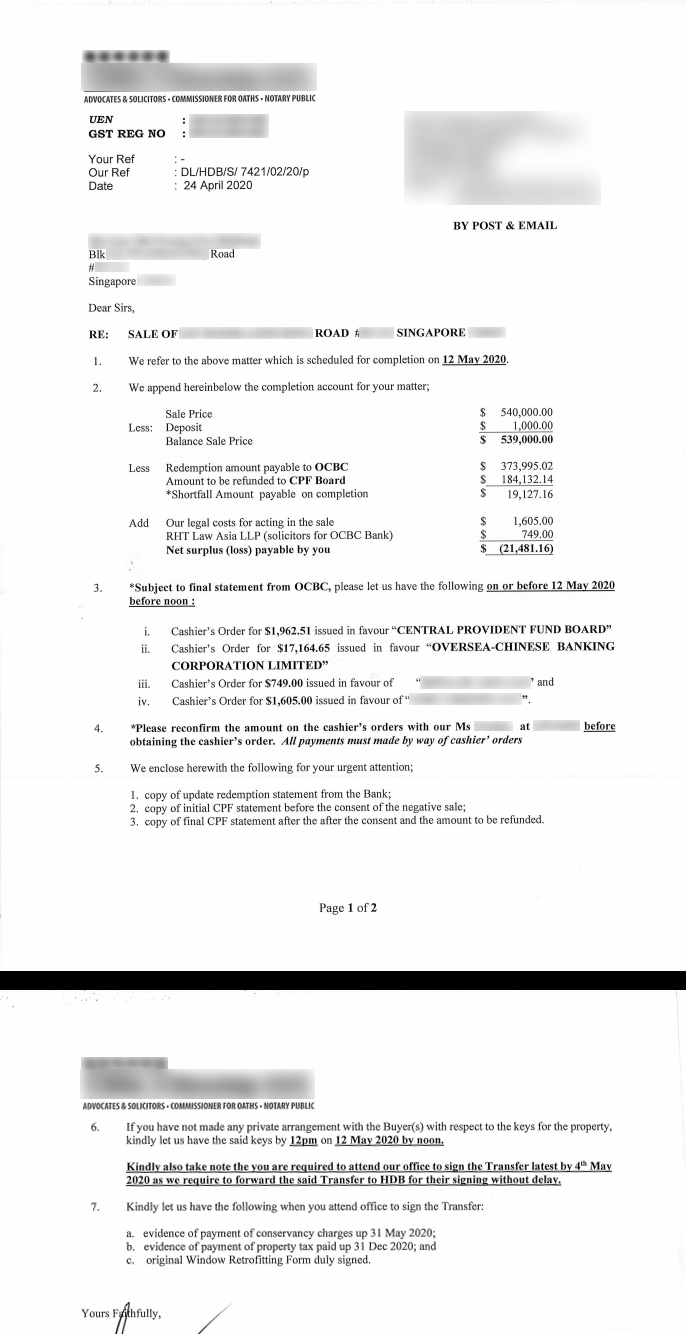

IRS Verification of Non-filing Letter requested by telephone cannot be sent directly to a third party by the IRS.

28+ irs non filing letter sample. An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040 1040A or 1040EZ for the year you requested. I _____ certify that I attempted to obtain a verification of non -filing letter Non-Filers Printed Name from the IRS by the following means please mark appropriate box. You are due a larger or smaller refund.

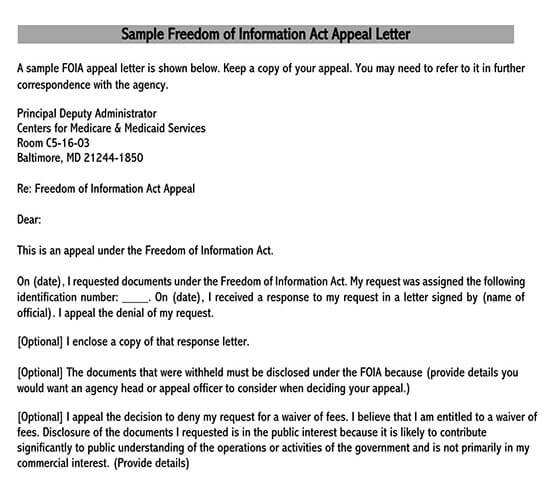

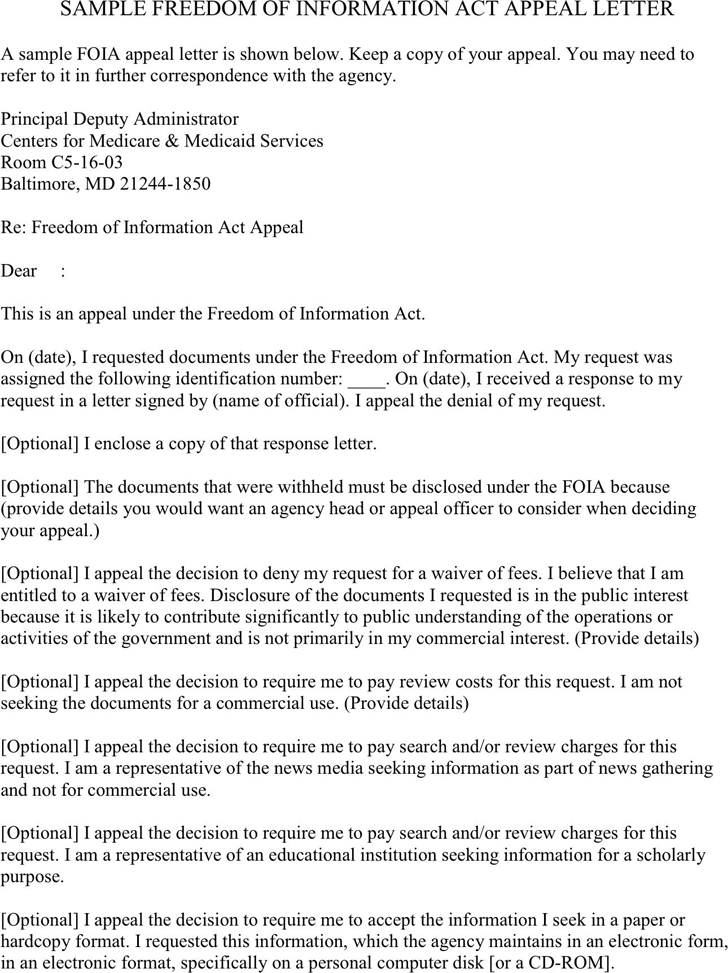

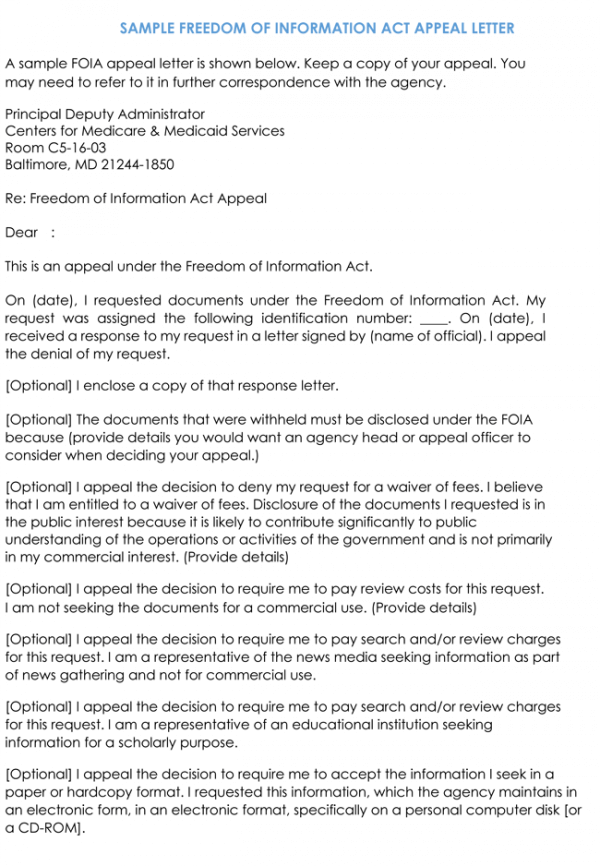

I am writing to respectfully request the abatement of penalties totaling ENTER DOLLAR AMOUNT that was assessed related to the attached notice dated ENTER DATE OF NOTICE. If successfully validated non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 10 to 15 days from the time of the request. To get a copy of your IRS notice or letter in Braille or large print visit the Information About the Alternative Media Center page for more details.

The IRS soon became concerned that many streamlined filing were being made with only a general statement of the conclusion of non-willfulness without supporting facts being included. Sign and submit the IRS Verification of Non-filing Letter if requested to Marquette Central. How to fix address matching problems when ordering online.

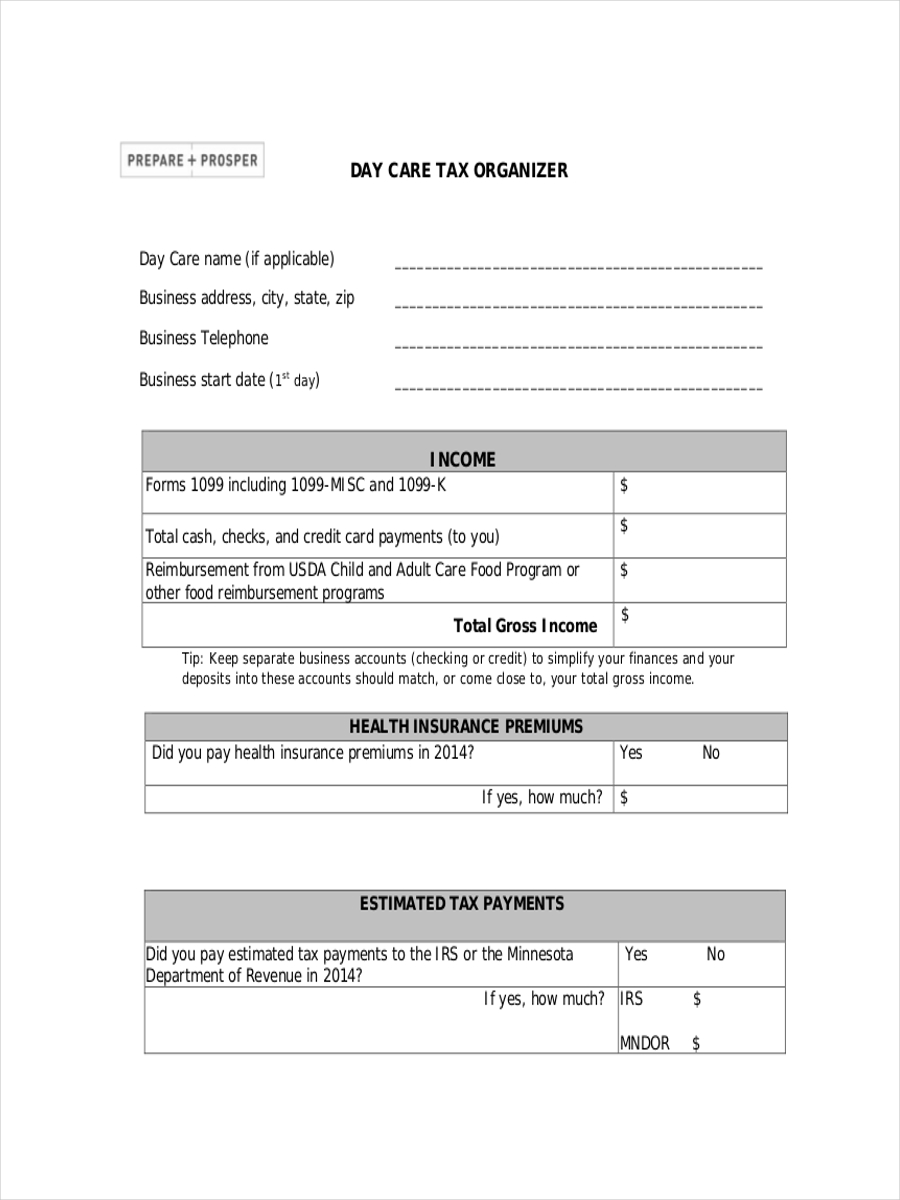

To get the VNF a taxpayer must first send IRS Form 4506-T. The IRS sends notices and letters for the following reasons. Non-Tax filers can request an IRS Verification of Non-filing of their tax return status free of charge from the IRS.

What is an IRS Verification of Nonfiling Letter. The IRS Verification of Non-filing Letter will be required if student spouse if applicable or parent s indicate on the FAFSA andor the Verification Worksheet that an IRS Tax Return was not filed. Why was I notified by the IRS.

Each nontax filer is required to provide the letter. HOW TO contact US ification Of nonfiling Of returns of a filed Form 1040 1040A or can consider this letter a o re rding this letter or Please call us at if you have any questio if you need additional information. A nonfiling letter will be necessary for all parties in the custodial household ie.

Requesting this form can be challenging for many students here are a few things to know. Initially Forms 14653 and 14654 stated only that streamlined filers had to submit reasons in support of the conclusion that their conduct in non-filing or non-reporting was non-willful. When entering the information into the IRS address matching system note the following.

The address entered must match the address already on file with the IRS exactly. Fill out the information asked in lines 1 to 4 of the form. Student parent 1 parent 2 spouse that did not file taxes.

Download IRS Form 4506-T. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. The IRS will use this information to confirm eligibility calculate and send an Economic Impact Payment.

Make sure to include the students name and UW student ID number on the letter. If the taxpayer wants the IRS non-filing letter sent to a different address use Line 5. Writing a letter of explanation to the IRS after receiving a notice can be a daunting task whether its for penalty waivers adjusted refunds or for cp 2000.

I attempted to obtain a verification of non- filing letter from the IRS by submitting IRS form 4506-T to the IRS. Line 3 must show what the IRS has on record. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

An IRS Verification of Nonfiling Letter VNF will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested. Submit the IRS Verification of Non-filing Letter if requested to the Office of Student Financial Aid. Enter Payment Info Here Then provide basic information including Social Security number name address and dependents.

Paper Request Form IRS Form 4506-T. We have a question about your tax return. Other please explain your attempt to obtain the non -filing letter.

Economic Impact Payments were an advance payment of the Recovery Rebate Credit. After the taxpayer has the form on hand they should. This is a Letter to the Tax Office Inland Revenue Department requesting to waive the late filing payment penalty because of various reasons including relying on an unreliable professional firm.

The sender is writing to request waiving the penalty interest regarding his. To request a IRS Verification of Non-filing Letter visit. Select Option 2 to request an IRS Verification of Non-filing Letter and then enter 2015.

IRS Penalty Abatement Sample Letter Template. Make sure to include the students name and Marquette ID on the letter. First visit IRSgov and look for Non-Filers.

The primary reason that. You have a balance due. IRS Verification of Non-Filing Letter October 2020 Students who apply for financial aid who did not file a tax return for the requested year may be asked to submit verification of Non-Filing VNF evidence from the IRS.

I waited at least 10 days and have not received a response back. Read these steps to ensure you are completing the necessary steps and including the right information.

28 Acknowledgement Letters Free Samples Examples Formats Download Free Premium Templates

Free 10 Affidavit Of Support Samples And Templates In Pdf Ms Word

32 Paraprofessional Cover Letter With No Experience Sample Letter Cover Letter Experience Cover Letter For Resume Job Cover Letter Sample Resume Cover Letter

Business Letter Handbook

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Charitable Donation Receipt Letter Template Donation Letter Templates Charitable Donations Lettering

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Free 8 Tax Receipt Examples Samples In Pdf Doc Examples

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Business Letter Handbook

How To Write An Exemption Letter

Sample Response To Irs Notice Form Template Irs Irs Forms No Response

Non Cash Contribution Letter Template Donation Letter Business Letter Template Letter Templates

Ali Darwish Thesis Framing Social Sciences Al Jazeera

Hardship Letter Template 05 Lettering Reading Lesson Plan Template Homeschool Lesson Plans Template

Free 8 Sample Payment Received Receipt Letter Templates In Pdf Ms Word Google Docs Pages

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt

Get 26 Sample Appeal Letter To Waive Interest Charges Kasual Shirt